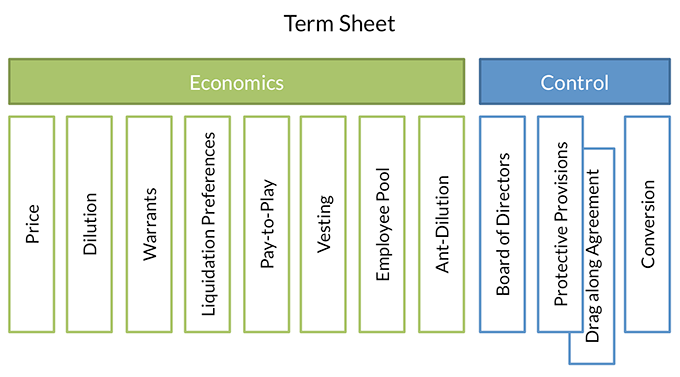

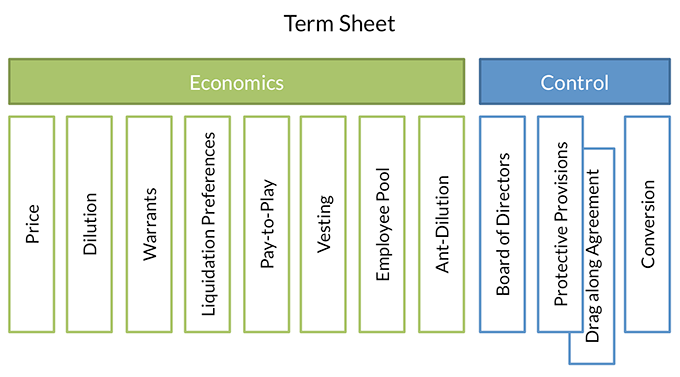

When entrepreneurs seek to raise capital from venture capitalists (VCs), VCs only focus on two aspects:

1- Economic: All that is in some way related to the return on investment of the investor.

2. Control: the mechanisms that allow the VC to exercise control over the business and its decisions.

In the following figure, the most important clauses in the semester are related to the two above-mentioned topics.

One of the most important advantages that VCs demand for an entrepreneur when investing is the "Liquidation Preference," whose main function is to prioritize the payment and protection of the VC capital principle in key events.

Below are some types of revisions to this clause in the venture capital contracts.

First edition (According to NVCA Term Sheet):

|

Liquidation Preference

|

In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows:

|

|

|

[Alternative 1 (non-participating Preferred Stock): First pay [one] times the Original Purchase Price [plus accrued dividends] [plus declared and unpaid dividends] on each share of Series A Preferred (or, if greater, the amount that the Series A Preferred would receive on an as-converted basis). The balance of any proceeds shall be distributed pro rata to holders of Common Stock.]

|

|

|

[Alternative 2 (full participating Preferred Stock): First pay [one] times the Original Purchase Price [plus accrued dividends] [plus declared and unpaid dividends] on each share of Series A Preferred. Thereafter, the Series A Preferred participates with the Common Stock pro rata on an as-converted basis.]

|

|

|

[Alternative 3 (cap on Preferred Stock participation rights): First pay [one] times the Original Purchase Price [plus accrued dividends] [plus declared and unpaid dividends] on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis until the holders of Series A Preferred receive an aggregate of [_____] times the Original Purchase Price.]

|

Second edition:

This clause in VC contracts indicates that the right to receive revenues with the VC is a priority in events that lead to the company being criticized (sale, liquidation, etc.) or payment of profits. This score is generally presented in two forms:

1. Actual Preference: x Returns to the VC invested capital.

2. Participation:

Full: In this case, VC will first take on the principle of its capital and continue to participate in the same proportion as the other shareholder in the remaining earnings.

Capped: VC first takes the principle of its capital and then contributes to the rest of the proceeds up to the ceiling x equal to its original capital.

No: VC similar to the usual shareholder, contributes to the proportion of equity in the proceeds.

Comments

No Comments Yet